Crypto And The Apocalypse

The Optimistic Thought Experiment

“The mind is its own place, and in itself, can make a heaven of hell, a hell of heaven.” - John Milton

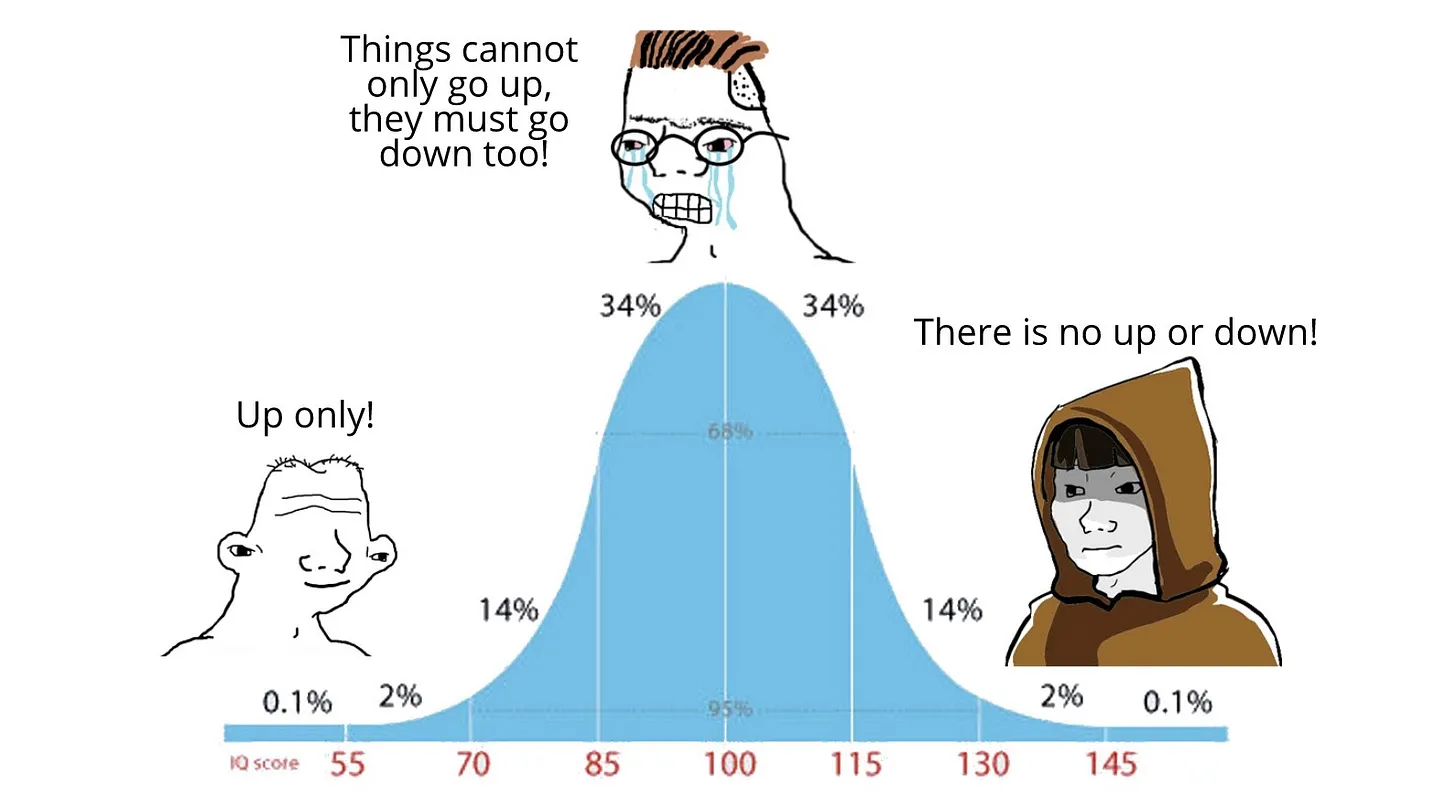

For every projection of a global cryptoparadise there is an equivalent where crypto is crushed by regulators or revealed as the ultimate ponzi. Inevitably, the future is found between these extremes.

There are no good individual investments in crypto if this novel belief system and economic organization fails. No crypto bet is a micro bet alone. If crypto as a macro bet fails then any idiosyncratic thesis for why this app should get traction is useless.

To date, almost every crypto bubble has involved a serious miscalculation about the true probability of successful crypto adoption. This is changing. What used to be a bottom-up thesis of user adoption is now dominated by a top-down narrative about future growth and capital inflows.

The grand crypto thesis is not about retail adoption. “The institutions are here” meme matters more. For over a decade the establishment financiers were in denial. Crypto was drug money, rat poison and a ponzi. But throughout the years the mainstream narrative of crypto evolved from dodgy to edgy and from edgy to Pascal’s wager.

After years of denial and anger many red-pilled traditional investors will make a sudden U-turn and overcompensate. As the resources of obfuscation at hands of the Boomer world order lose power and are forced to become radical, many investors will be pushed to believe crypto is the “The Promised Land”, heralding the inevitability of crypto.

The only way out of the debt crisis is economic growth. And I don’t mean 3% GDP kind of growth, we’re talking “nuclear fusion” kind of growth. But there are very limited opportunities in today's world for such outcomes. Through hope, desperation, and a tangible lack of alternatives, financial capital will flow into crypto.

In the next few years, I expect to see investors’ FOMO and FUD both concentrating in areas most levered to crypto and its top-down adoption. The extreme valuations in crypto may be an indirect measure of the narrowness of the path set before us - crypto becomes a liquidity black hole.

We now reside in a world in which we value things at what they could become, not what they are. A belief system centered on exponential outcomes, both good and bad, dictates the future. The alternative is an apocalypse of hyperinflation, pandemics, high rates and wars.

The apocalypse has no place in the world of money and cannot be factored in when making investments. There is no winning bet if the world ends. Monetary accounting tricks are our only way to preserve some kind of future. Markets continue to pretend that the emperor is clothed.

But markets are never wrong. Markets are mirrors. They are Wittgenstein’s Ruler, meaning they tell us more about our desires than what is actually happening. They also show us a collective belief about the future. And the great thing about the future is that it is flexible.

We are experiencing near peak insanity and peak clarity at the same time. Peak insanity from the perspective of the old valuation models, because through this lens, this clown world makes no sense.

Peak clarity because we need things to be priced even higher than they are. If they are not it means they are not valuable and we have failed - progress has stalled and the exponential future narrative is dead.

Consider Thiel’s take on the dotcom bubble:

“The narrative was that the valuation made sense because of the promising future ahead. The real value is always in the future. Absent a very specific future you can point to, people anchor to a very specific past.”

The way I have chosen to explain it is that the future is reflexive and the past is analytic. Valuations do not have to make sense to you today. Sometimes even optimistic versions of the future become self-fulfilling.

Some say the present fails to make sense and posit that we live in the post value world. The “post value” is just a nihilistic exclamation. I don’t agree with the post-value thesis. On the contrary, I would characterize it as a pre-value, because the value lives in the future.

Value never exists independently of observers and it is not contained in the-thing-itself. Value only exists in the minds of knowledge-bearing entities. Beyond food and shelter it is very hard to define objective value to a human being. We collectively define what is valuable.

No action ever happens in isolation. Especially in a hyperconnected world of abstract numbers on computer screens. We live in a metaverse that is founded on imitation. Into it, we feed actions – inputs causing reflexive actions that reshape the world around us.

We make sense of the world by creating it. Collectively, we have come up with an economic game, making up metrics that serve as coordination points. Today, the absurdity of old rules are made evident, so we bend them - reinventing new rules on the go. The most important rule:

The past makes sense. The benefit of hindsight is an application of shared stories to agreed upon events. The future is always chaos. When outcomes become increasingly unpredictable, man often seeks refuge in the arms of pessimism. This is one of the great themes of history: perpetual apocalypse. Or more accurately, the expectation of it.

Pessimism is at the core of human socialization. Why are Zerohedge and zombie movies so popular? People indulge in imitating the extreme pessimism of others. It’s easy because most pessimism invites inactivity and is self-fulfilling. Optimism is costlier because it requires, at minimum, some vulnerability.

Crypto is our optimistic thought experiment. It is our hedge against the dystopian or apocalyptic future. We are doubling down because we cannot derisk. Therefore, by our metrics, the poison becomes the cure.

We have cornered ourselves into hyperfinancialization. To avoid apocalypse we will treat crypto as The Promised Land. But crypto is no heaven or hell. Crypto is a purgatory - suspended disbelief. It is a deal in which we buy time for human creativity to deliver exponential growth.

I’d like to thank Shaun for his valuable inputs and Fiskantes for a steady supply of peak nihilism.

Subscribe to Wrong A Lot

Musings of the optimist

Fantastic as always. Thanks for sharing your thoughts.

Good stuff - enjoyed that.