A correct model of Olympus DAO

The purpose of this post is to describe a correct model of Olympus DAO.

People seem very confused about how to understand or analyze Olympus DAO. I am correcting the record.

We will first discuss the inapplicability of “decentralized reserve currency” or “game theory” as lenses through which Olympus DAO can be understood. Next, we will present the correct model, which is as a continuous treasury bootstrap (bonding) accompanied by a continuous treasury distribution mechanism (rebases). Finally, we will present an overall narrative for the spectacular rise and ongoing decline of Olympus DAO within the framework we have created.

“Decentralized reserve currency” is nonsense

What is a reserve currency? Wikipedia tells us:

A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

Reading this, it’s natural to ask: why does one government want to hold reserves of another government’s currency? According to Investopedia:

A reserve currency reduces exchange rate risk since there’s no need for a country to exchange its currency for the reserve currency to do trade.

Reserve currency helps facilitate global transactions, including investments and international debt obligations.

A large percentage of commodities are priced in the reserve currency, causing countries to hold this currency to pay for these goods.

Two observations immediately stand out. First, it’s unclear why decentralized finance needs a “decentralized reserve currency.” Second, it’s unclear why $OHM qualifies as a reserve currency.

The primary motivation for creating a decentralized reserve currency, according to the Olympus DAO FAQ [1], is that transacting in USD-based stablecoins exposes you to risk from US Federal Reserve monetary policy. Although this is true, that doesn’t mean that a decentralized reserve currency is a meaningful solution. The proposed problem is that the USD might be “debased,” i.e., the purchasing power of 1 USD might change substantially on a short timescale. However, implicit in that statement is a comparison to some standard basket of goods and services against which the purchasing power of the USD precipitiously declines. Given that usage of cryptocurrency is fundamentally global, it is questionable that any attempt to create a decentralized currency with stable purchasing power against a standard basket of goods and services will succeed, because there is no such thing as a global standard basket of goods and services to begin with.

Even if one accepted the premise that DeFi needs a decentralized reserve currency, it is unclear that Olympus DAO would serve appropriately as one. For example, their FAQ states that $OHM is “backed by a basket of assets.” However, one can readily observe that this “basket of assets” is primarily composed of USD-pegged stablecoins, with highly volatile cryptoassets making up another large chunk. This exposes $OHM to hypothetical USD debasement risk as well as extreme cryptoasset volatility, and it is thereby unclear how using $OHM as a currency would actually be superior to using USD-pegged stablecoins (whether centralized or algorithmic).

Going beyond these two observations, it is apparent that Olympus DAO does not have a clear grasp on what exactly they mean by “decentralized reserve currency.” For example, they claim that OHM “draws its intrinsic value from … fractional treasury reserves.” What is a “fractional treasury reserve”? I am not sure. In fact, if you Google “fractional treasury reserve,” the only search results are those related to Olympus and forks thereof. I am left with the impression that the writer was familiar with the phrases “fractional reserve banking” and “treasury reserves” and decided to incoherently mash them together — not confidence-inspiring. Similarly, they analogize their “decentralized asset” holdings to the gold standard. However, in the recent cryptocurrency market downturn, all of these assets — with substantial beta exposure — declined in correlation with the broader market. In contrast, gold is commonly understood as a zero beta asset with approximately no market exposure [2]. Failing to understand this distinction calls into question their understanding of the basic macroeconomic concepts which they fling around with wild abandon.

(3,3) as game theory is nonsense

In the Olympus DAO FAQ, they make the following claims about staking $OHM:

(3,3) is the idea that, if everyone cooperated in Olympus, it would generate the greatest gain for everyone (from a game theory standpoint).

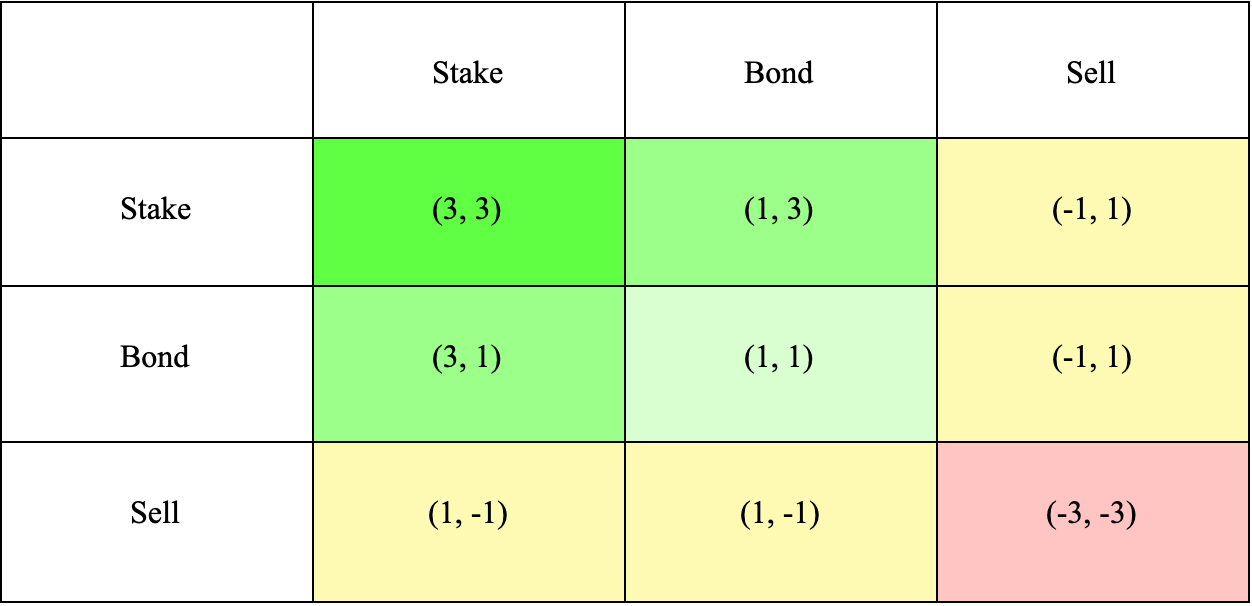

This “game theory” is illustrated with the following diagram:

Unfortunately, this is mathematical gibberish. It is equivalently bad to writing down a series of nonsensical expressions, e.g.,

1 + 2 = 6

4 – 2 = 100

2 * 5 = -5

and claiming that you are performing arithmetic. Although you are using numbers as well as arithmetic symbols, you would not be performing arithmetic, nor would those statements be arithmetically valid. Instead, they would simply be nonsense.

There is one simple and obvious problem — (3,3) is simply and transparently gibberish. Olympus DAO claims:

If we both stake (3, 3), it is the best thing for both of us and the protocol (3 + 3 = 6).

This statement implies that the act of purchasing and staking $OHM is positive-sum. However, buying, staking, and selling $OHM are essentially all “rearrangements” of money within a closed system. In the absence of positive value generation (e.g., legitimate business activity), it is a priori impossible for all participants to experience a (3, 3, …, 3) outcome, for the simple reason that shuffling money around in a closed system without any productive activity cannot create positive value, much in the same way that for every person profiting from buying $DOGE or $SHIB, some other participant is necessarily losing out. Note that in the situation where all participants buy and stake and nobody sells, everyone can have arbitrarily large paper gains; however, it is impossible for all participants to realize gains at the maximal price and the amount of money flowing out must necessarily be strictly limited by the amount of money which flowed in.

The situation is now slightly different with the launch of Olympus Pro and the generation of revenue using the Olympus treasury. However, for quite a large period, there was zero generation of value occurring. (Accrual of LP fees from $OHM trading does not count, as that is again simply shuffling around money between participants entering and exiting a closed system.)

Setting aside the approximately zero-sum nature of Olympus DAO, it should also be immediately apparent that buying and remaining staked indefinitely is not the optimal strategy. Each participant is clearly incentivized to buy before they believe other participants will buy and to sell before they believe other participants will sell, as in any other asset market. Assuming that the price of 1 $OHM is initialized to treasury backing, in the absence of expected future cashflows and a revenue distribution mechanism for $OHM holders, the fair value of 1 $OHM should be at most equal to backing, and assuming other participants are rational, the Nash equilibrium is to not purchase $OHM at that price. Similarly, assuming that 1 $OHM trades at a premium to backing, you should eventually expect a convergence to backing value or below, and therefore the optimal move is to not buy and to sell all present holdings unless you expect persistent irrationality of other market participants to drive the price up substantially in the near future.

Bonding is a continuous treasury bootstrap

At any given point in time, bonding $OHM is effectively participating in a funding round at current market prices minus the bond discount. A market participant pays a token of some given value to the treasury in return for newly minted $OHM vesting over multiple days. Because bonds are always active, an $OHM bond must be continually sold at a discount from the market value of $OHM; otherwise, it would be strictly preferable to purchase $OHM on the market so that $OHM can accrue rebases during the vesting period.

The frequency at which people are observed to purchase bonds is unusual, because arbitrage between the rebase yield and the bond discount should mean that a marginal purchaser of $OHM should be indifferent between an open market purchase of $OHM and a purchase of an $OHM bond, with the exception that a large order size might have substantially lower slippage if executed via a bond. I suspect that people like bonds simply because they are “discounted,” even if bonding is not in fact clearly superior to a market purchase.

Rebases are a treasury distribution mechanism

The rebase feature of Olympus DAO potentially accommodates multiple interpretations. However, I believe that it is simplest to interpret this feature as a treasury distribution mechanism.

Observe that the rebase APY is guaranteed to be positive as long as the backing per $OHM is above $1 as well as the fact that the protocol mechanically guarantees a $1 price floor per $OHM. Therefore, given sufficient time, the staked supply of $OHM will converge to the treasury balance and every participant will be able to redeem their $OHM for, at minimum, a proportional share of the treasury. Therefore, one can conceive of the thrice-daily rebases as a continuous distribution of a claim on the Olympus treasury to $OHM stakers.

For example, if ten people each stake equivalent amounts of $OHM, then given sufficient time each will at least be able to claim 10% of the treasury. They may also be able to sell $OHM on the open market for the value of that claim plus a speculative premium. However, I prefer to focus on the price floor mechanism, which makes it clear that the rebases serve essentially as a continuous flow of treasury emissions to $OHM stakers.

In my opinion, this is qualitatively similar to more standard forms of cryptoeconomic token dividends, such as protocol buy-and-burn or direct token emissions (the two of which are theoretically equivalent). However, because of the complex machinery, e.g. the time-varying APY, the actual financial flow to $OHM stakers is highly obscured.

What is Olympus DAO?

Having covered the above material, I believe we can now give a succint yet accurate model of Olympus DAO.

Olympus DAO began as a protocol designed to bootstrap the accumulation of a large treasury. Due to the proliferation of inaccurate narratives — e.g. the “decentralized reserve currency” narrative, the implied notion that the rebase APY was in some sense “earning” you money above and beyond the guaranteed price floor per $OHM, and the Olympus team messaging describing the protocol as a “ponzu,” among other aspects — this led to the accumulation of a large speculative premium in two distinct runups.

Eventually, as the size of the treasury grew larger, the Olympus DAO team began to generate productive value with that treasury. For example, they began to yield farm, and they also developed Olympus Pro, a service which they sell to other DAOs. These services currently bring in on the order of 60 million dollars per month. This inflow of money is balanced by the continuous outflow of a guaranteed treasury claim via the rebase mechanism. Furthermore, the always-on bonding mechanism also helps to continuously grow the treasury.

Fundamentally, I believe that the extremely obscure and time-lagged treasury distribution mechanism (rebases) does not justify a high premium above backing price. In fact, I believe that 1 $OHM should trade well below backing:

- The rebase mechanism renders it complex to liquidate your future guaranteed proportional claim on the treasury and also makes it difficult to reason financially about what you are actually gaining and losing

- The rebase mechanism obscures the flow of money in and out of the protocol, making it difficult to properly value 1 $OHM

- Yield farming has lower returns at scale, and LP positions can be entered as an individual, so it should (disregarding transaction fees) be strictly superior to yield farm and LP yourself rather than to do it through Olympus as a proxy

As the market realized this — either explicitly or implicitly — the speculative premium corresponding collapsed.

References

[1] https://docs.olympusdao.finance/main/basics/basics

[2] https://papers.ssrn.com/sol3/papers.cfm?Abstract_id=920496

Leave a Reply