Maelstrom

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

One of the most destructive mental constructs to the health of your financial portfolio is measuring yearly arithmetic returns. The goal, as always, is to maintain or increase the purchasing power of your assets relative to the cost of energy. Human civilisation essentially converts the potential energy of the Sun and Earth into kinetic energy that supports our bodily functions and modern lifestyle. Making money is not the goal, because money is just an energy abstraction. The correct — and admittedly difficult to track — means of measuring your financial success is determining how many barrels of oil your lifestyle costs now and how many it will cost in the future. Then you must ensure the value of your financial savings increases faster than your expected energy consumption.

The markets don’t stop just because the clock ticked 12:01 AM on 1 January 2022. Returns are compound and path-dependent in nature. Unfortunately, there are only a few trading days that actually matter. A simple example will illustrate this point.

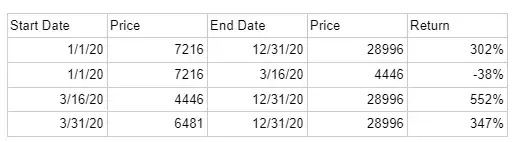

Travel back to 1 January 2020, when the world was a simpler place and the global coronavirus madness had not yet taken hold. Bitcoin fetched $7,216. The last day of that fine year, Bitcoin commanded a price of $28,996. The YoY arithmetic return was 302%. Who made more, Bitcoin investors or Pfizer?

While that is an impressive one-year return, it belies the intense market dislocation experienced in Mid-March. Let’s zoom in on the month of March 2020.

On 16 March, Bitcoin experienced a correlation 1 moment and got clobbered — along with every other risk asset globally — as the world (ex-China) discovered the COVID-19 pandemic was real, real bad. A correlation 1 moment is when all risk assets fall together, as investors at the margin rush to sell anything to raise the global reserve currency (currently the US Dollar) so that they can pay back loans. Nothing is spared. Only once the dust settles and fear dissipates do assets once again begin moving in more idiosyncratic ways.

From 1 January to 16 March, the price of Bitcoin swooned by 38%. Many people got stopped out, either mentally or forcibly. (A mental stop out is when the price of an asset reaches some internal pain point that forces you to push the “sell” button. A forced stop out is when your leverage provider closes your positions to preserve some collateral value.)

The above table illustrates the good and the bad of path-dependent outcomes. The most important lesson is that 16 March trading behavior was by far the most important day of the entire year. The very good traders who were strapped into their trading spaceships had the opportunity to drastically improve their portfolio’s returns. The return from the low of the 16th to the end of the year was 250 percentage points above the investor who was fully invested from Jan 1.

If you were unlucky enough to exit your position on the 16th but possessed the mental and financial wherewithal to rebuy into the market, the date on which you regained your position was extremely important. Bitcoin did not recover to the 1 Jan level until 21 April. The longer you waited, the worse your compounded 2020 return became.

The readers who are active traders MUST be present for any and all days like 16 March. Reducing risk during an event like the 16th, and adding it back shortly after the puke out, is what creates stellar compounded returns.

For those readers who would rather not babysit their Bitcoin 24/7, you must construct a portfolio that behaves in a convex fashion when there are calamitous days such as 16 March. The most important mental hurdle to overcome is to ditch the notion of year-on-year arithmetic returns, and instead view your performance as compounded over time. The above example illustrates the negative effects of compounding should you cease to protect the downside AND be unable to participate in the rebound on the upside.

To do the above, you must remove emotion from your investment decisions and use a judicious amount of leverage. The former requires more skill than the latter, simply because of how difficult it can be to completely overhaul the way you think about your investments (particularly given that most investment literature focuses on arithmetic returns). Even worse is that all fiduciaries (i.e., money managers) are paid on yearly bonus cycles. If your money manager loses all of your assets, SFYL and the worst that can happen to them is temporary unemployment. But if things go well, you must pay them percentage points of your returns every year, destroying your compounded returns over time. I don’t have a solution for the agency problem — just remember that it exists and adjust your behaviour accordingly.

The point of this Bitcoin price history lesson is to tee up a discussion about how I’m positioning my portfolio this year, in advance of what I believe will be a string of trading days as disastrous as 16 March 2020. As usual, this relates to the Fed reducing the growth of their balance sheet to 0%, and subsequently raising rates one to three times in 2022.

I will start off with a short discussion on why interest rates matter, and then get into how positive short-term policy rates set by the central bank of the Empire will, on a three-to-six-month time horizon, inflict max pain on global risk assets. I ultimately believe that the Fed and other lemming central bankers around the world have no choice at the moment but to continue printing money — but at some point soon the domestic politics of many nations will likely necessitate a tighter monetary supply in order to quell dissent from the plebes whose cost of food, shelter, and transportation is going up and to the right bigly!

Listen Up

When it comes to central banking, being as transparent as possible about future actions is en vogue. However, the high clergy refuses to admit, in the face of obvious data that suggests otherwise, that money printing is the cause of inflation that tears society asunder. Those who have listened and done what they were told since the Great Recession of 2008 have stacked serious fiat ducats. Those who cared about funderrrrrmentals and other such nonsense have underperformed. Stop being a dumbass and buy the fucking dip!

While policy often changes, the Fed is very clear about what they intend to do. “Transitory” inflation now resides in the bin, and the Fed has signaled that they think it’s time to tame food, energy, and transportation inflation at the cost of financial asset prices. To that end, they decreed that they will cease purchasing bonds by March of this year, and if their “dot plot” holds true, the first rate hike will occur between March and June.

Most market participants believe the Democrats — who must prove they are tough on inflation to avert a total ass-whooping in the November congressional elections — will instruct the Fed to raise interest rates, and the Fed will oblige. But there is less consensus regarding how a series of short-term interest rate hikes will impact financial assets — i.e., whether they will weather the storm, or buckle under the pressure.

Let’s forget what non-crypto investors believe; my read on the sentiment of crypto investors is that they naively believe network and user growth fundamentals of the entire complex will allow crypto assets to continue their upward trajectory unabated.

To me, this presents the setup for a severe washout, as the pernicious effects of rising interest rates on future cash flows will likely prompt speculators and investors at the margin to dump or severely reduce their crypto holdings. I do not doubt that the faithful diamond hands will continue to accumulate as prices plummet. However, in the very short term, this dry powder will not be able to prevent a calamitous fall in prices at the margin. Remember, if 1 Bitcoin trades at $20,000, the last price is $20,000. It doesn’t matter if there are almost 19 million other Bitcoin in existence. The last traded price is instructive of where the marginal seller will part with their Sats, and is also a chimera due to the small size traded.

The most damaging impact of the last traded price is on the psyche of weak paper hands, and it influences when leveraged trading platforms liquidate underwater positions. Therefore, don’t tell me about how all the crypto OG’s are busy buying the dip; it won’t matter when the risk manager — either inside your head or IRL — rugs your position.

Crypto investors salivated for over a decade over the impending entrance of “institutional” investors into the space. Now, they are finally here, as the below Bloomberg headline indicates. While the percentage asset allocation is small, there are enough believers from the TradFi world to make a difference.

Billionaires Are Embracing Crypto in Case Money ‘Goes to Hell’

The article discusses how luminary CEOs and investors such as Tom Peterffy (InteractiveBrokers) and Ray Dalio (Bridgewater) own Bitcoin and other cryptos as a hedge against the demise of fiat currencies.

While wealthy individuals who run large TradFi companies can withstand a serious drawdown in price, the lemmings that follow them cannot. The asset management industry is perfectly happy to invest in crypto so long as when prices fall, these overpaid copypasta chefs don’t lose their well-paid jobs. They don’t believe in or hold any allegiance to Lord Satoshi. Therefore, if external conditions warrant the reduction of their crypto allocations, they will not hesitate to liquidate their positions — regardless of the magnitude of the loss.

Institutional investors are beholden to the power of the EuroDollar. That is, USD held outside the domestic American banking system. Essentially, the world is short dollars. When the price of dollars falls, credit expands, and financial assets are happy. When the price of dollars rises, credit contracts and financial assets get a sad face. Read Alhambra Investments’ blog for a more in-depth discussion on how this market functions.

The rate of change in the growth of the money supply, its first derivative, is the most important factor in determining whether institutional investors are Positive Paulines or Debbie Downers.

The white line is US M2% YoY growth. M2 grew gradually in 2019. In March 2020 the Fed, using its magic money printer, nationalised the corporate bond markets and saved the US Treasury market by bailing out a bunch of overleveraged macro hedge funds. This caused the jump in M2% growth. The Fed balance sheet growth, and as a result M2% slowed the larger it became (law of large numbers), and the US government didn’t enact enough fiscal spending to continue the need for accelerating the money printer.

Currently, the Fed forecasts growth of their balance sheet to slow to zero. If they do not reinvest the maturing bonds in their portfolio, their balance sheet will actually contract. My ugly white arrow in the chart above demonstrates the impact this will likely have on the money supply.

The yellow line is the Bitcoin/USD price. The loose US monetary conditions definitely influenced the meteoric rise in price (albeit a few months delayed). Since M2% growth stalled, Bitcoin has traded sideways. If M2 is set to hit 0% — and possibly even go negative — in short order, the natural conclusion is that Bitcoin (absent any asymptotic growth in the number of users or transactions processed via the network) is likely to go much lower as well.

I could paste more chart porn depicting various countries’ credit impulses rolling over, but they all paint the same picture. The villagers woke up because the cost of meat, veggies, a taxi ride, rents, and other essentials is rising faster than their wages. Now they are trained on Public Enemy №1 — inflation. If domestic politicians worldwide want to keep riding the gravy train, they have to pretend to do something. Therefore, it’s time for central bankers to put on some kabuki theatre and, at least for a short while, pretend like they are willing to unwind their balance sheets and return to positive interest rates that reflect the reality of various domestic economies.

The Benchmark

Bitcoin is the cryptographic representation of money / energy.

Ethereum is the internet’s decentralised computer.

For the most part, every other major crypto asset can be categorised in the following ways.

- Tokens tied to Layer 1 protocols that are looking to become “the next Bitcoin or Ethereum.” Said coins are more scalable, can handle more transactions per second, are actually anonymous, and/or have a mining reward system that encourages decentralisation. Monero is to Bitcoin what Solana is to Ethereum.

- Tokens that use existing Layer 1 protocols — most frequently Bitcoin or Ethereum — as a means to accomplish some desired function. One example would be Axie Infinity, a token-based play-to-earn game that uses NFT assets residing on the Ethereum blockchain.

Either a token is trying to be a better version of Bitcoin or Ethereum, or it is leveraging the features of either network to create a new product or service.

Bitcoin and Ethereum both have some pretty glaring shortcomings, and if another crypto can supplant either one, its value will naturally explode. Anyone who discovered said token early would become extremely crypto rich. There are a number of Layer 1 protocols that possess a high and rising hopium premium. These protocols trade on hope, because the fundamentals (e.g., number of wallet addresses or amount of actual transaction fees paid in the native currency) pale in comparison to Bitcoin or Ethereum. This doesn’t mean that, over a long enough time period, a particular coin couldn’t become top dog. However, we are not concerned about the long term. We are concerned about the next 3 to 6 months, and protecting the downside in our portfolio.

With respect to tokens that rely on the Bitcoin or Ethereum blockchains for their functionality, those tokens should not (in theory) be worth more than the protocols they are built on top of. It’s the difference between investing in a general vs. specific application of a technology — the general version has more potential to power multiple successful specific iterations; therefore, the general version should be more highly valued. While there will almost always be a significant gap between the market caps of Ether and an ERC-20 dAPP, the dAPP can outperform Ether on a price appreciation basis over a selected timeframe. But on the way down, said dAPP will lose more value faster than Ether.

That is how I view the world. As a result, I benchmark all returns in my crypto portfolio against either Bitcoin or Ethereum. I entered the crypto complex by selling fiat to purchase Bitcoin and Ether. These coins always lead a given rally, and then it’s time to buy low and sell high the hopium premium in shitcoins. In the process, my holdings of Bitcoin and Ether may expand.

If I believe that Bitcoin could trade below $30,000 and Ether below $2,000 in a three-to-six month time horizon, I will dump all of my shitcoins. That is because Bitcoin and Ether are the highest quality coins, and they will decline less than all their yet-to-be-proven competitors. Any specific applications that use the Bitcoin or Ether blockchain will also experience gravity at greater than 9.8m/s. These shitcoins could go down 75% to 90% in a true crypto risk-off environment.

The TradFi system reacts primarily to the gyrations of the cost of EuroDollars. The crypto capital markets may react at the margin to the Bitcoin and Ether money markets. I don’t have hard data on this, but my hunch is that there are billions of dollars worth of Bitcoin and Ether currently pledged as collateral. Holders deposited Bitcoin / Ether and received dollars in return. These dollars were used to buy assets such as cars or houses, as well as punt altcoins. If you believe we are in a bull market and you already own the benchmark, as a trader, it makes sense to lever up and purchase an altcoin that could easily pump 10x if Bitcoin rises another 10%.

Regardless of whether you purchased a sick pad or more SHIB, if Bitcoin or Ether falls 20% to 30%, you will be forced to sell assets and raise Bitcoin or Ether in order to avoid forced liquidation. The contraction of the fiat price of the benchmark assets will cause some traders on the margin to indiscriminately dump their altcoin positions, regardless of whether they are in the money or not. This is the power of the last price influenced by marginal weak hand sellers.

It doesn’t take much marginal selling pressure to prick the hopium bubble. Fuck all those high farming APYs — as soon as the underlying shitcoin starts pooping, everyone will head to exit to monetise their unrealised gains. Even if only a small slice of traders acquired their altcoin positions in a leveraged fashion, on the way down it will be hard to find bids in size due to the illiquidity of these coins. Remember, big door in, small door out.

Timeline

What if I’m wrong? What harm visits my portfolio if the crypto bull market continues without a major drawdown?

March to June

During this time period, the Fed will have either hiked or not hiked. The market expects the Fed to raise rates, and they would only disappoint if one of three things transpire:

- Recorded Consumer Price Index (CPI) growth numbers decline below 2%. Given the way this index is “managed” by government statisticians, it is almost impossible for that to happen. But if the CPI trend is sharply lower and the political pressure from pissed off constituents dissipates, then maybe the Fed can publicly reverse course.

- Some parts of the extremely complex and opaque money and US Treasury markets break. You will know it when you see it — and it is the one thing the Fed is deathly afraid of. Given that all TradFi assets are valued using prices from the US money markets, the Fed must ensure this market functions in an orderly manner at all costs. Usually, restoring order necessitates printing a fuck ton of money.

- Inflation ceases to be the number one issue American voters care about in the run up to the November elections.

Of these three scenarios, I consider the second one to be the most likely to occur. No one can predict what will happen to the money/Treasury markets when the Fed stops providing the juice. There is so much leverage embedded in the system that it’s impossible to know whether the methadone will kill the junkie.

Given the law of large numbers, a simple resumption of the previous trend in asset purchases will not cause the growth of the money supply to suddenly and sharply accelerate. Therefore, while risky assets would rejoice — crypto included — the best case is that asset purchases slowly grind higher towards their previous all-time highs. Even if that happens, the only way the crypto markets would move up is if the Fed publicly turned on the taps, and then fiat flowed into crypto.

If that starts to happen, there will be plenty of time to either sell fiat and increase the overall size of your crypto holdings, and/or move out on the crypto risk curve by increasing your altcoin holdings. You always take the stairs up, and the elevator down.

If I’m wrong, I will not suffer significant missed gains as the crypto markets resume their march higher. Being patient will not cost much.

June Onwards

Assuming I’m right and the Fed has hiked at least once by the June meeting, if any one of the following scenarios occur, the Fed will abruptly slash rates to zero and run the printing press faster than Usain Bolt:

- The SPX trades down 20% to 30% from its all-time high (reached in 1H 2022). Whether you are an Asian or European net exporter or a wealthy American, you likely own a gigantic amount of American equities. The US stonk market is the best performing stonk market of any developed country. It also is the largest and most liquid. There are too many rich people who pay taxes and profligately consume for the Fed to let them down if the equity markets wobble hardcore. Another interesting reflexive fact is that the traditional wisdom of maintaining a 60 / 40 equities-to-bonds portfolio mix means that if the 60% in equities declines, fund managers of trillions of dollars automatically must sell bonds to maintain the ratio. It is literally written into the mandate. Thus, if the Fed allows equity prices to fall, it will increase the borrowing costs of the federal government — because as bond prices fall, yields rise — at a time when the government is running record deficits.

- Some parts of the extremely complex and opaque money and US Treasury markets break.

- The November 2022 elections are over.

Worst case, the party gets going again after November. Neither US political party actually wants to halt the rise in asset prices. Both parties prove their value by shouting to the world: “I was in power, and the S&P 500 rose!” It makes everyone rich, and keeps your wealthy donors happy. After the plebes go through the theatrics of voting and expressing their displeasure at the skyrocketing cost of living, they can be forgotten about until the next election. The government will then get back to the business of pumping financial asset prices with printed money. It’s the business model of America, and one that must be maintained due to the structure of the global economy.

Chaos

I do not actively trade around my positions. My goal is to construct a portfolio I believe will participate in the upside while limiting the damage of any downside. As I mentioned before, I done good if my portfolio’s return profile is convex. While I spent the majority of this essay talking about the crypto side of my portfolio, I expect my long interest rates and FX options portfolio — sourced via my investment in a volatility hedge fund — to make up for any losses on the crypto side of the book. However, if I’m being honest with myself, I probably need to add more so that I warehouse enough vega to make a difference on the downbeat.

What I don’t want to do is sit in front of my screen for hours on end, day after day, babysitting my Bitcoin. I don’t enjoy that. Some traders do and are successful short-term traders. But these traders are dedicated to their craft. If you can’t or won’t be on call 24/7 to babysit your crypto portfolio, don’t attempt to trade in and out of positions on a short time horizon.

As these thoughts percolated in my mind over the last few weeks, I gained the resolve to take action. I went through my entire crypto portfolio. After a 75% drop from the current levels, any shitcoin I wouldn’t increase my position in, I dumped. That left me with Bitcoin, Ether, and a few other large positions in metaverse and algorithmic, stablecoin-related tokens. Large or small isn’t a function of the nominal amount of units you hold of a given asset; it’s a function of the percentage of your total portfolio they comprise. A 100 Bitcoin position is too large for some, and too small for others. Everything is relative.

Now, I wait. I am still fully invested in my benchmark crypto assets. Your crypto benchmarks may or may not be similar to mine. I gave you my reasons, and you should think through why you believe your benchmark is valid in the context of your energy goals.

If Bitcoin trades at or below $20,000 or Ether trades at or below $1,400, then I will start to wonder whether these cryptos can preserve their value in energy terms. Those two levels were the previous all-time highs during the 2017 bull market. But that’s the fiat price, if oil goes negative again then who cares if the benchmark cryptos fetch fewer fiat units.

Armed with fiat dry powder, I stand ready for the capitulation candle. I’ve been trading these markets long enough to spot the last-gasp, puke-out candle that breaks the soul of the speculative bulls. Even though I’m confident in my abilities to spot a bottom, I learned the hard way not to try and catch a falling knife. So what if you don’t bottom-tick the market? Let the market heal, and buy it higher with more confidence that the marginal paper handed seller is finished.

Those who sell first, sell best. The time is now to evaluate the conviction you have in whether positive interest rates could seriously damage your portfolio’s ability to purchase a constant or increasing amount of energy. Regardless of how hard every government tries to stifle the volatility of the universe, the normal state of play is chaos. We Are Entropy!